Retire Confidently.

Deals

Invested

Assets

Managed

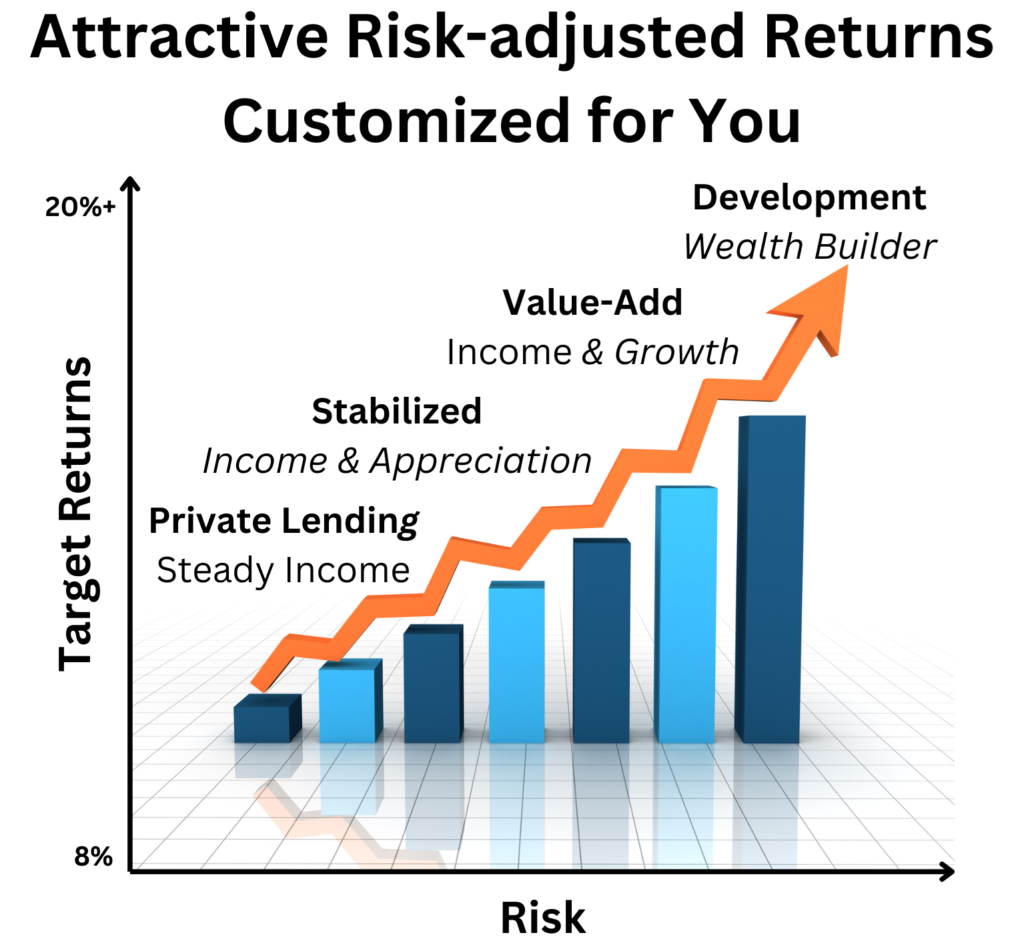

10%-20%

Target

Returns

Real Estate

Experience

Why Navigator Wealth Fund?

- Exceptional communication

- Operational excellence

- Diversified long and short-term offerings

- You’re in control

- Customized portfolio (by you)

- Single K1

- Tax advantages

- Accepting self-directed accounts (SD-IRA)

Navigator makes it easy to choose the right investments to round out your portfolio and achieve your retirement and wealth building objectives.

Start

Explore

Fund

Allocate

Relax

Getting Started

- We are here to help you.

- Introduce yourself and receive new deal alerts using the Get Started button.

- Schedule a call so we can learn about you, share valuable resources and help you draft a plan.

Explore Opportunities

- Check out our portfolio of open investment opportunities.

- We offer highly-curated opportunities that target immediate cash flow and long-term wealth building with an attractive risk-return profile.

- Register for an account

- Review the offering materials.

- Verify accredited investor status.

- Submit Funds.

Select Investments

- Select a custom portfolio by choosing investments that fit your objectives.

- Review specific deal disclosure documents.

- Request allocation to the selected investment.

- As the investment creates distributions, your capital account will be credited.

- Depending on the investment, distributions may occur throughout the holding period at the end or both.

- Capital is returned when the investment liquidates. You may re-invest your cash capital or have it returned to you.

Start

Getting Started

- We are here to help you.

- Introduce yourself and receive new deal alerts using the Get Started button.

- Schedule a call so we can learn about you, share valuable resources and help you draft a plan.

Explore

Explore Opportunities

- Check out our portfolio of open investment opportunities.

- We offer highly-curated opportunities that target immediate cash flow and long-term wealth building with an attractive risk-return profile.

Fund

- Register for an account

- Review the offering materials.

- Verify accredited investor status.

- Submit Funds.

Allocate

- Select a custom portfolio by choosing investments that fit your objectives.

- Review specific deal disclosure documents.

- Request allocation to the selected investment.

Relax

- As the investment creates distributions, your capital account will be credited.

- Depending on the investment, distributions may occur throughout the holding period at the end or both.

- Capital is returned when the investment liquidates. You may re-invest your cash capital or have it returned to you.

Why Private Markets?

Consistent returns, even when public markets falter.

A key component to modern investment portfolios.

1. Diversification:

Private market investments often exhibit different risk and return characteristics compared to traditional public market investments (like stocks and bonds). Including them in a portfolio can help in reducing overall portfolio volatility and improve risk-adjusted returns.

2. Potential for Higher Returns:

Private market investments often offer the potential for higher returns.

3. Access to Different Opportunities:

Private markets provide access to investment opportunities that are not available in public markets, such as investing in specialized real estate projects.

4. Inflation Hedge:

Certain private market investments, like real estate, can serve as a hedge against inflation, as they often can pass on inflationary pressures through increased rents or prices.

5. Long-term Investment Horizons:

Private market investments typically have longer investment horizons and command an illiquidity premium. This can be beneficial for investors with long-term goals, as these investments can potentially yield higher returns over extended periods.

6. Reduced Market Correlation:

Private investments often have lower correlation with traditional equity and fixed income markets, providing a cushion during periods of market turbulence.

7. Expert Management:

Managed by specialized teams. This expert management can potentially lead to better investment selection and value creation strategies compared, especially compared with a “do it yourself” approach to real estate investing.